Ever wondered how companies make confident decisions in a fast-changing world? The kind backed by insight, not guesswork? That’s where primary research comes in.

When you need answers tailored to your audience—fresh data, collected first-hand and built around your goals—primary research gives you exactly that. Whether you’re testing a new idea, exploring a market shift, or just getting closer to your customers, it’s one of the most direct and reliable ways to move forward.

What is primary research?

At its core, primary research is the process of collecting data directly from the source. You’re not reading what someone else has already published—you’re asking the questions, running the surveys, observing the behaviour, or testing your ideas yourself.

This creates what’s known as primary data: new, original information gathered for a specific purpose. It’s the opposite of secondary research, where you’re working with data that already exists—like reports, government statistics, or someone else’s survey.

So if you’re wondering what is primary data and how is it different from secondary data—it’s simple. Primary means collected firsthand. Secondary means collected by others.

Why use primary research?

There’s a good reason businesses, marketers, and researchers rely on it. Primary research gives you:

- Relevant, up-to-date insight tailored to your specific goals

- Control over your method—you decide how the data is collected and who from

- Accuracy and depth that generic sources can’t offer

- Confidence in your decisions, because you know exactly where the data came from

It’s especially useful when you’re working on something new, testing a hunch, or refining your strategy.

Benefits of primary research

Let’s break it down. The key advantages of primary market research are:

- Tailored to your objectives – You ask the questions that matter to your organisation

- Fresh and current – You’re working with real-time data

- Unique insights – It’s information your competitors don’t have

- Flexibility – You can adapt your approach as you go

- Depth – Go beyond the surface to understand the “why” behind the numbers

In short, primary research gives you clarity, especially when the stakes are high or the question is too specific for existing data to answer.

Primary vs. secondary research

If you’re still unsure about the difference between primary and secondary research, here’s a quick comparison.

Primary research

- You collect the data yourself

- Designed to answer a specific question

- Takes time and planning

- Highly relevant and original

Secondary research

- Uses existing data (e.g. reports, statistics, articles)

- Faster and often cheaper

- Good for background or context

- May be outdated or not specific enough

You’ll often use both: secondary research to frame the problem, and primary research to dig into the details.

Wondering what counts as secondary data? Think government reports, academic journals, competitor websites, or internal sales records. That’s desk research—and yes, it has its own advantages and disadvantages too.

Primary research methods

There’s no single right way to collect primary data. It depends on what you’re trying to learn. Here are a few of the most common primary research methods:

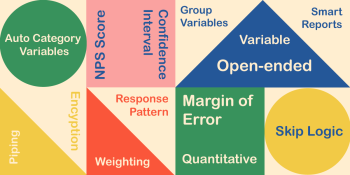

Surveys and questionnaires

Ideal for collecting structured data from a large group. Whether you’re gathering feedback on a product or testing a concept, surveys help you spot trends quickly.

Interviews

More personal, less structured. Interviews let you explore thoughts, feelings, and motivations in depth—perfect when you’re looking for context.

Focus groups

Small group discussions that surface a range of opinions, reactions, and ideas. Great for early-stage testing and exploring messaging.

Observational research

Watch how people behave in real environments—online or offline—without asking them to explain. This method can uncover real-world habits that surveys miss.

Experiments and A/B testing

Test two (or more) variations to see which performs better. It’s a powerful way to validate decisions—especially in UX, product, or marketing.

Case studies

A deep dive into a single subject, event, or customer journey. Case studies are great for rich, contextual understanding, especially in B2B or service design.

Real-world examples

Here’s what primary research can look like in action:

- A retail brand surveys customers to find out what they really want from a loyalty programme

- A local council observes foot traffic to decide where to place new signage

- A SaaS startup runs A/B tests on landing pages to increase signups

- A healthcare provider interviews patients to improve service delivery

- A product team holds focus groups to shape messaging for a new launch

Each of these examples shows how primary research in business leads to decisions grounded in real data, not assumptions.

Are there any downsides?

Of course. Like any method, primary research has limitations.

Disadvantages of primary data

- It takes time and planning – You’re not just Googling a stat

- It can be resource-intensive – Especially if you need large samples or specialist tools

- Smaller scale – Results might not apply to the wider population

- Requires skill – Poor survey design or biased questions can affect results

Still, when done well, the benefits of primary research usually outweigh the challenges—especially if you need clear, confident answers.

What about secondary data?

Secondary research plays a valuable role too. Sometimes you don’t need to start from scratch—there’s already data out there that can help.

Benefits of secondary data

- Quick and cost-effective

- Great for benchmarking or early-stage planning

- Useful for shaping your primary research

- Some sources—like government reports—are highly credible

Disadvantages of secondary research

- It might not match your audience or context

- Data could be outdated

- You can’t verify how it was collected

- In business, relying too heavily on it can lead to generic decisions

That’s why many teams use a mix of primary and secondary research—giving you both speed and depth.

Planning your research

Thinking about running your own study? Here’s how to approach it:

- Set your goal

What do you want to learn? What decision will this data support? - Choose your method

Pick based on time, budget, and the type of insight you need. - Define your audience

Who do you need to hear from? What makes them relevant? - Design your tools

Write clear, focused questions—and test them before you go live. - Collect, analyse, act

Keep the process ethical, objective, and open to insight.

Whether you’re running a simple online survey or launching a multi-stage user study, good planning is what turns data into decisions.

Final thoughts

Primary research is your direct line to real answers. It’s how you listen, learn, and act with confidence.

And it’s not just for big corporations or research departments. Even small teams can use primary research to improve products, services, and strategy—without the guesswork.

At Snap Surveys, we make it easier to do it right—from survey tools and data collection to analysis and reporting. So if you’re ready to get closer to the people who matter, we’re here to help.

Ready to get started? Try Snap Surveys for free or talk to our research services team about your project.